Customer interviews and surveys to guide business and design decisions

Client

CORT Furniture Rental (a Berkshire Hathaway company)

Role

UX/UI Designer

Skills

Correspondence with customers - existing and lost

Writing interview and survey questions

Conducting exploratory, qualitative phone interviews

Executing online surveys via Usabilla feedback platform

Analyzing all results and feedback

Prepping presentations

2017 - 2018

Overview

Objective

Gather customer (current, potential and lost customers) insights about the company’s current digital experience, then use these insights to spark and back up ideas for new website designs and features.

Context

CORT was entering a new digital-oriented phase, trying to catch up with shiny new competitors. To justify business changes and design decisions we conducted surveys and other methods of exploratory research.

Outcome

We learned a lot from our research and accordingly recommended pricing changes for packages; new content strategy; simpler, more modern designs; and more look-books, education and inspiration.

Problem

The company was looking to increase overall customer conversion and wanted to gather user feedback to ground ideas for business decisions and website design.

Users and Audience

The audiences we focused on for research were current B2C customers who went in-store rather than online, lost military customers, and lost student customers. These audiences had already been offered an ecommerce experience on the website, so we wanted to determine either why they went in-store, OR why we lost them as customers. Answers could vary from being website-oriented to business-oriented.

My Role

My role was to implement our exploratory customer research process through phone interviews as well as gathering feedback through various methods on the website.

Constraints

While we had a large user-base to pitch for our phone interviews, we received limited responses, so we only had 11 interviews to analyze. From a qualitative point-of-view, the feedback was extremely valuable. From a quantitative point-of-view, the population size was not large enough for an accurate depiction of the majority of customers’ thoughts.

We also did not have a streamlined process for presenting our feedback to higher-level stakeholders and executives. We did, however, have a decent process for presenting to our customer service representatives so they could follow up with customers as needed.

Process

Phone Interviews: I was tasked with conducting customer interviews via the phone. This process included writing or editing interview questions and scheduling 11 qualitative phone interviews among three customer types. Questions themselves were generally qualitative and the interviews were casual.

I took notes and wrote quotes throughout the interviews and analyzed the feedback for key takeaways. I created a report that outlined and summarized key takeaways, supported by quotes. A colleague presented these results to the marketing team, and another colleague presented these results to our customer service team.

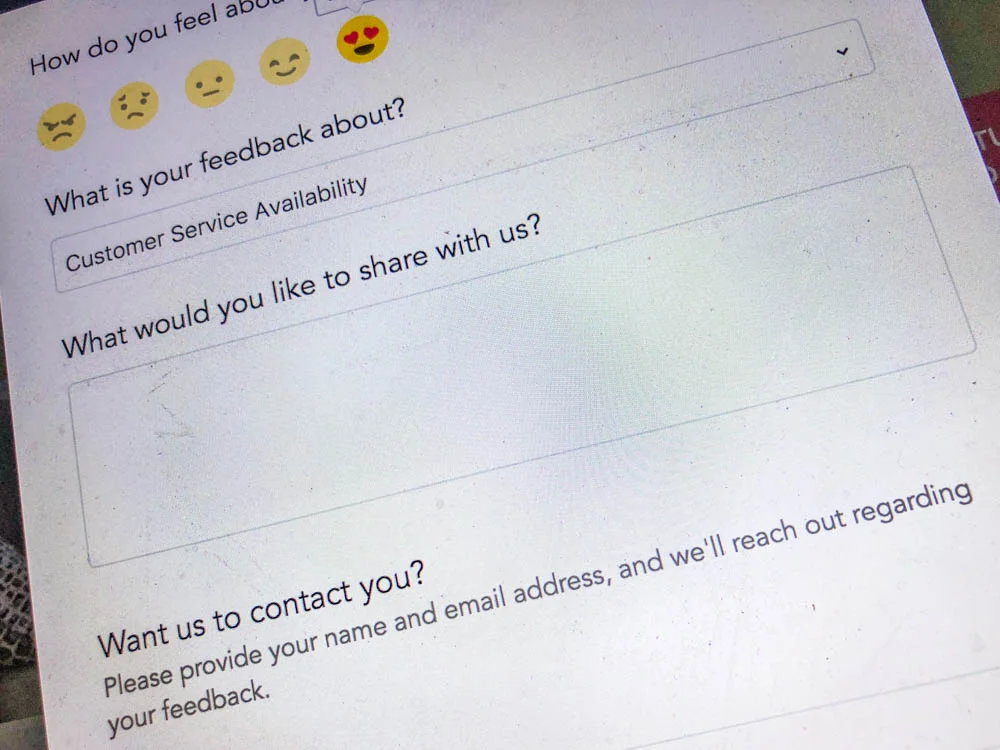

Website Feedback: I was also in charge of gathering feedback through our website, via a feedback button, exit surveys, and slide-out surveys on specific website pages. I wrote the survey questions, set up the surveys through a software called Usabilla, and designed the look and feel of the surveys. I regularly reviewed and sent this feedback to the customer service team. I also analyzed this feedback and created monthly reports, which my colleague then presented to the marketing team and other stakeholders.

Through both methods, conclusions included: we should implement more e-commerce functionality for the user, such as being able to change their credit card information online; customers and lost customers agreed that they had a good experience with our customer service; pricing was great for most markets, but students felt it was too high.

Lessons Learned

One of my colleagues inputs all feedback into Salesforce for reporting purposes, but as it stands, our feedback is too qualitative for accurate and automated reporting. We began looking to add more quantifiable elements to our interviews and surveys for easier and more accurate reporting through Salesforce. I also would have liked to have a process for presenting business-oriented feedback to higher-level stakeholders in the company so they can make educated business decisions efficiently and effectively.